ARTICLE AD BOX

Major tech players like Google, Meta, Microsoft, and Amazon are spending unprecedented amounts to scale up their AI infrastructure.

In the past three months alone, these companies have invested a combined $112 billion. To cover these massive expenses, they're increasingly relying on loans and complex financing strategies. These include bonds secured by data centers and special purpose vehicles that keep debt off their balance sheets, according to the New York Times.

Blackstone is planning to raise $3.46 billion through a data center bond, while Meta has used a special purpose vehicle to finance $30 billion for a new data center. Morgan Stanley projects that private lenders will need to supply $800 billion over the next two years to meet the sector's appetite for capital.

Rising debt levels create new risks for tech and finance

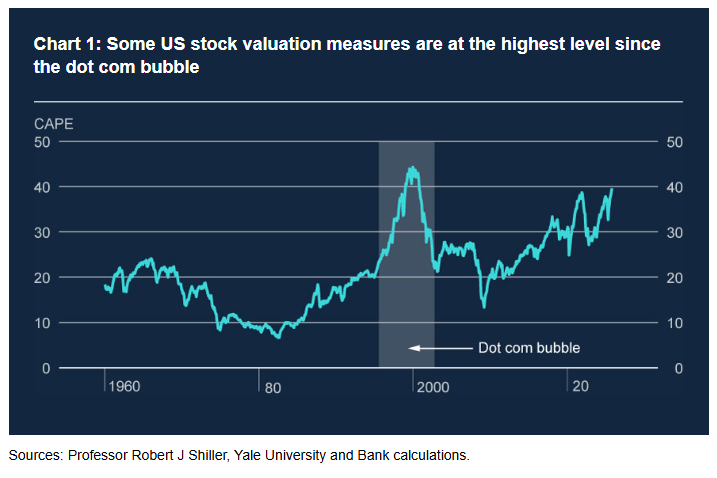

Experts are warning that the mounting debt could destabilize both the tech sector and financial markets. Only about three percent of consumers are currently willing to pay for AI services. The Bank of England cautions that if these hyperscalers can't cover their capital costs through profits, systemic risks could leak into the broader credit markets. "This is a fast-evolving topic, and the future is highly uncertain," the Bank wrote in late October.

Ad

THE DECODER Newsletter

The most important AI news straight to your inbox.

✓ Weekly

✓ Free

✓ Cancel at any time

Meanwhile, banks like Sumitomo Mitsui, BNP Paribas, and Goldman Sachs are backing an $18 billion loan for OpenAI's Stargate data center in New Mexico, The Information reports. This is just part of a wider expansion, which includes a $38 billion push for additional data center sites in Texas and Wisconsin.

Self-reinforcing financial loops add to instability

Another layer of risk comes from the circular flow of capital between tech companies. Hyperscalers like Oracle, Google, and Microsoft invest in firms such as OpenAI, which then spend that money back on cloud and hardware from those same hyperscalers. OpenAI's contracts for roughly $1 trillion in compute have already secured more than 20 gigawatts of capacity, driving further growth in hyperscaler stocks.

Soaring AI infrastructure investment has pushed US tech stock valuations to new highs. | Image: via BoE

Soaring AI infrastructure investment has pushed US tech stock valuations to new highs. | Image: via BoEOpenAI CEO Sam Altman has publicly defended the company's planned $1.4 trillion in AI investments in response to bubble concerns. His call for government support to help build AI infrastructure, however, has only intensified debate over the risks involved.

1 hour ago

1

1 hour ago

1